I forgot to post this little bit that I submitted to Raleigh N&O. It appeared with minor edits on February 23.

***********************************************

When I was young the hated word “socialism” stopped conversations. Today, “democratic socialism” leads to conversations about the great, underused productive capacity of our nation. Modern day democratic socialists understand how our monetary system can work for the poor among us and maintain thriving, green industries that do not pollute our air and water.

We have put our great productive nation to work before. We did it to win World War II. We built a transcontinental highway system. We put men on the moon. Then we lost our way. Regan told us government was the problem not the solution. We bought into his tricky, trickle-down economics. Clinton ran budget surpluses that led to the great financial crisis.

Sanders understands that we can increase our productivity, raise people out of poverty, make health care, social security, and education human rights. And, federal deficits for the public purpose can increase our productivity to its maximum.

Our challenge is to find better ways to communicate to all advocates of progressive policies how money and our banking system really work and the key role the federal government can play in sustaining full employment for all those wanting work. Maybe you can help.

Thursday, March 5, 2020

What Biden needs to know about deficits

I rewrote the previous post in keeping with with current news. I think I might have submitted it to the New York Times through a strange invitation at the bottom of one of its articles.

*********************************************************

Joe Biden is well on his way to becoming the Democrat presidential nominee. Unfortunately, like former President Obama, Biden misunderstands government spending. Under his leadership, our country may again fail to live up to its promise by curtailing federal deficits.

The prevailing notion is that government, like a household, must borrow from the private sector to raise money to spend. Also, this errant notion claims that taxes confiscate dollars from households and businesses. Nowhere does this belief explain the origin of dollars.

The real story goes like this. Upon authorization from Congress, the federal government creates dollars to buy goods and services from the private sector. Then, government takes back some of those dollars through taxation. Fundamentally, dollars are tax credits that all taxpayers must acquire to meet their tax obligation. Taxation creates a demand for taxpaying citizens to acquire dollars by working for the government or providing goods and services to others.

The Treasury sells securities (borrows) to soak up the dollars remaining in the private sector after taxation. Those treasuries remain in the private sector as savings, and the interest on them is income to the private sector.

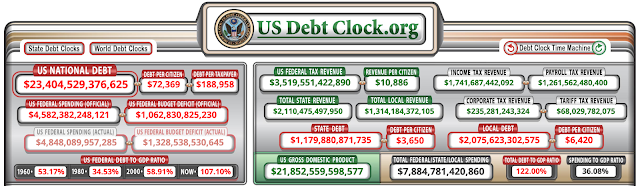

The infamous government debt clock is actually a savings clock. The private sector doesn’t owe the national debt; it owns it! When Sally-six-pack looks at the debt per capita she should ask, “Where’s my share?” Government must answer her.

It should be clear that dollars must exist in the private sector before tax collection or treasury sales are possible. That is, government must spend before it can tax or borrow. Like tickets collected at the ballpark, dollars must exist in the economy before collection is possible.

Future generations benefit from federal investment in infrastructure, research, and education. Also, they get to keep the savings in the economy. The national debt resulting from deficits is never paid off. The Treasury just rolls debt over and over. Imagine a bank doing that with a mortgage. The bank wants the debt paid off during the lifetime of the borrower; the Treasury expects our government to last forever.

Few realize that in the last fiscal year the Treasury redeemed $90 trillion in securities and issued $91 trillion. Government debt is approaching $23 trillion while private debt is $32 trillion. It’s the private debt that really must be paid off!

Naysayers raise the specter of hyperinflation - Weimar! Zimbabwe! - when they consider government creating money. They miss the point. Government uses the money created to buy real goods and services not to pour money out into the street. Inflation occurs not from too much money but from a lack of productivity or natural resources. Government can always buy what is for sale in US dollars including lumber or labor.

While the deficit hawks implore the government to live within its means, deficit owls know better. They implore government to live up to its means. The productive capabilities of the USA are legendary. Still, we fail to employ all who want a job, and we fall into the neoliberal trap that anything worth doing is worth doing for profit. So, we denigrate public service and let people suffer and die from lack of housing and health care.

Understanding how our fiscal system works allows us to realize much greater production and more equitable distribution of our nation’s vast wealth. We must use deficits wisely as they can enrich the rich or uplift the poor.

Don’t scoff at big ideas like full employment, universal healthcare and a Green New Deal. We didn’t win World War II, build a transcontinental highway system, and put men on the moon by cringing before deficits.

*********************************************************

Joe Biden is well on his way to becoming the Democrat presidential nominee. Unfortunately, like former President Obama, Biden misunderstands government spending. Under his leadership, our country may again fail to live up to its promise by curtailing federal deficits.

The prevailing notion is that government, like a household, must borrow from the private sector to raise money to spend. Also, this errant notion claims that taxes confiscate dollars from households and businesses. Nowhere does this belief explain the origin of dollars.

The real story goes like this. Upon authorization from Congress, the federal government creates dollars to buy goods and services from the private sector. Then, government takes back some of those dollars through taxation. Fundamentally, dollars are tax credits that all taxpayers must acquire to meet their tax obligation. Taxation creates a demand for taxpaying citizens to acquire dollars by working for the government or providing goods and services to others.

The Treasury sells securities (borrows) to soak up the dollars remaining in the private sector after taxation. Those treasuries remain in the private sector as savings, and the interest on them is income to the private sector.

The infamous government debt clock is actually a savings clock. The private sector doesn’t owe the national debt; it owns it! When Sally-six-pack looks at the debt per capita she should ask, “Where’s my share?” Government must answer her.

|

| The Debt Clock misrepresents the national debt as an amount owed rather than an amount owned by the public |

It should be clear that dollars must exist in the private sector before tax collection or treasury sales are possible. That is, government must spend before it can tax or borrow. Like tickets collected at the ballpark, dollars must exist in the economy before collection is possible.

Future generations benefit from federal investment in infrastructure, research, and education. Also, they get to keep the savings in the economy. The national debt resulting from deficits is never paid off. The Treasury just rolls debt over and over. Imagine a bank doing that with a mortgage. The bank wants the debt paid off during the lifetime of the borrower; the Treasury expects our government to last forever.

Few realize that in the last fiscal year the Treasury redeemed $90 trillion in securities and issued $91 trillion. Government debt is approaching $23 trillion while private debt is $32 trillion. It’s the private debt that really must be paid off!

Naysayers raise the specter of hyperinflation - Weimar! Zimbabwe! - when they consider government creating money. They miss the point. Government uses the money created to buy real goods and services not to pour money out into the street. Inflation occurs not from too much money but from a lack of productivity or natural resources. Government can always buy what is for sale in US dollars including lumber or labor.

While the deficit hawks implore the government to live within its means, deficit owls know better. They implore government to live up to its means. The productive capabilities of the USA are legendary. Still, we fail to employ all who want a job, and we fall into the neoliberal trap that anything worth doing is worth doing for profit. So, we denigrate public service and let people suffer and die from lack of housing and health care.

Understanding how our fiscal system works allows us to realize much greater production and more equitable distribution of our nation’s vast wealth. We must use deficits wisely as they can enrich the rich or uplift the poor.

Don’t scoff at big ideas like full employment, universal healthcare and a Green New Deal. We didn’t win World War II, build a transcontinental highway system, and put men on the moon by cringing before deficits.

Subscribe to:

Posts (Atom)